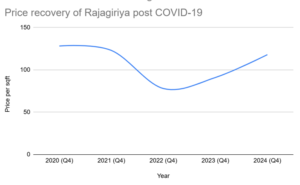

In 2024, Rajagiriya reaffirmed its position as one of the most constrained and high-potential suburbs in Colombo’s apartment market. With a 29.7% price increase year-over-year; rising from USD 91 to USD 118 per square foot from 2023 Q4 to 2024 Q4, it outperformed other suburbs such as Battaramulla (21.9%), Malabe (7.5%), and Thalawathugoda (24.6%). Only Mount Lavinia showed a comparable rebound of 29%, but with nearly 61% more supply than Rajagiriya.

Over the five-year span from Q4 2020 to Q4 2024, Rajagiriya’s has made remarkable recovery to its pre-pandemic prices. Its price recovery from the 2022 trough (USD 78 per sqft) to 2024 (USD 118) represents a 51.3% gain in just two years, the second highest among 13 other suburbs, only behind Mount Lavinia.

Figure 1: Price fluctuations of Rajagiriya

Source: RIUNIT

Supply rigidity and saturation metrics

Rajagiriya’s apartment stock has remained unchanged at 306 units since 2020, accounting for just 6.71% of the total apartment volume across the 13 surveyed suburbs by RIUNIT in 2024. In comparison, Dehiwela accounts for 19.54% (891 units), Athurugiriya 16.68% (761 units), and Battaramulla 12.6% (577 units). Despite its limited supply, Rajagiriya achieved a 100% absorption rate in both 2023 and 2024, joining just five other locations: Nugegoda, Ethul Kotte, Dehiwela, Wattala, and Ratmalana, in fully saturating inventory.

Average annual supply growth across the overall suburb regions was 24.22% from 2020 to 2024. Rajagiriya reported 0% growth during the same period, highlighting its severely limited development space. Dehiwela’s stock grew 39.4% over five years, and Nugegoda 25.2%, further diluting inventory value in those markets. Rajagiriya’s supply rigidity, combined with full absorption, creates scarcity-driven appreciation, especially attractive for mid- to long-term investors.

Figure 2: Supply of apartments in the suburban area

Source: RIUNIT

Source: RIUNIT

Implications of the Baili Investment development

In a market starved for new supply, Baili Investment’s upcoming mixed-use development, backed by a Hong Kong-based construction firm, becomes a high-leverage asset. What’s more captivating is, this project is the first mix development project in a Colombo suburban area and is expected to be the next business and entertainment hub. This upcoming large-scale mix development project in Rajagiriya offers luxury apartments plus a high end retail mall. In a general note, other upcoming projects are overwhelmingly located in outer zones such as Athurugiriya (488 units), Negombo (401), Ja-Ela (468), and Wadduwa (350), none of which match Rajagiriya’s centrality, infrastructure and its overall appeal.

While Athurugiriya, with 761 existing units and 2025 additional 500 units planned, is becoming oversupplied, Rajagiriya’s position remains protected by its land scarcity. Baili Investment’s development offers modern apartment living, wellness and fitness amenities, leisure spaces, and integrated retail facilities, catering to emerging buyer preferences for vertical, self-contained living ecosystems.

In short, Rajagiriya combines limited inventory (306 units), maximum absorption (100%), and a singular new project (Baili), with a 51.3% two-year price rebound. This convergence of factors defines it as a statistically rare and strategically superior investment destination in Colombo’s suburban apartment market.